Compass: This Real Estate Titan Is Too Good Of A Steal To Pass On (NYSE:COMP)

Hispanolistic/E+ by means of Getty Photos

No investor wishes to contact Compass (NYSE:COMP) correct now, and the reasons for that are straightforward to have an understanding of. It is a advancement inventory that is currently dropping revenue, which is 1 of the worst spots to be in in the course of the risky 2022 marketplace. On best of that, it really is a real estate organization – and with increasing charges and continued inventory tightness, all signals are pointing to a slowdown in transaction volumes, potentially to start out in the back again half of this year.

But as common, the market is having a really shorter-sighted approach to this inventory. When I get a action back from the shorter-expression noise on Compass, I nonetheless see a company that has promptly boosted by itself to the leading of the U.S. real estate market place in just a somewhat brief amount of yrs. It has develop into a family model identify for both of those house buyers and sellers, and has managed to carry on attaining current market share in an era the place far more small business is supposedly shifting to price cut brokerages like Redfin (RDFN).

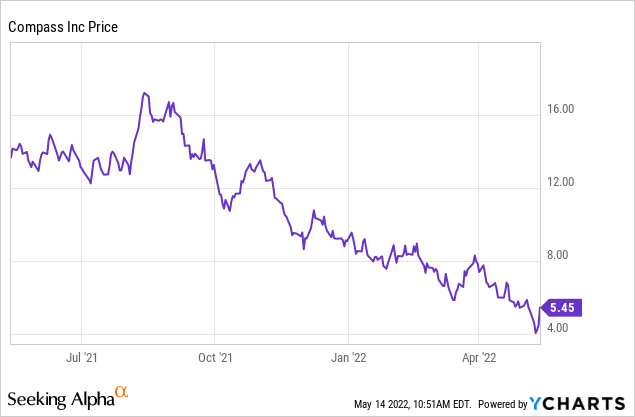

Calendar year to date, shares of Compass have shed 40% of their value vs . highs over $17 that Compass notched previous August, the stock is down by additional than two-thirds.

The Compass bullish thesis revisited

Supplied the steep drop in Compass stock about the previous several months, irrespective of the actuality that basic general performance carries on to maintain up, I’m upgrading my perspective on the inventory to solid acquire. I endorse that investors double down on this dip as I have, and even though Compass may well have a rocky few months ahead as real estate exercise potentially slows down (although I would argue this worry is by now baked into its inventory rate), it can be continue to properly-positioned to be a extended-phrase winner.

Here’s a complete rundown of the reasons to be bullish on Compass:

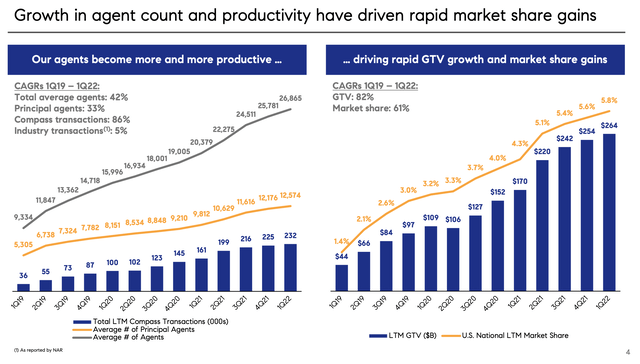

- Inside a several a long time, Compass has develop into a dominant brokerage. Compass’ market place share of U.S. real estate transactions is escalating speedily to ~6%. Presently deeply embedded into main coastal markets, Compass is a lot more a short while ago pushing into new business office alternatives in the Midwest. You will find nonetheless place for more enlargement: Even immediately after the new marketplace action this 12 months, Compass is continue to penetrated into a lot less than half of the U.S. population.

- Tertiary profits possibilities. Recently, Compass has been opening the door to new monetization prospects, such as commencing its own title enterprise. This positioning helps Compass derive more wallet share from real estate transactions as a full. Compass has commented that attach costs on these tertiary providers are growing. Compass estimates its U.S. TAM is $240 billion, of which only $95 billion and the rest is coming from adjacent services.

- Solid branding. Compass created a brand name all over currently being a full-support, higher-high-quality real estate brokerage, extremely identical in design and style and profile to competition like Berkshire Hathaway Household Companies or Sotheby’s. This provides the business a incredibly powerful distinguisher from other tech-initially rivals like Redfin.

- Scalable system. Compass’ main prices lie in the R&D shell out to provide its technological innovation platform for Compass brokers, as nicely as the income and internet marketing expenses of promoting its model to homebuyers/sellers and possible new agents. These fees are scalable: as Compass’ scale grows, and as agent efficiency grows (the regular Compass agent generates 19% additional revenue in the second year), Compass will be equipped to increase its profitability margins, which we have currently seen in the company’s most current effects.

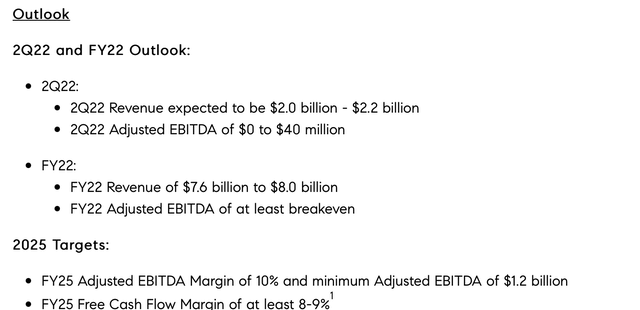

Be aware as perfectly that Compass has guided to “at the very least breakeven” adjusted EBITDA this year on a income profile of $7.6-$8. billion (flat to last yr, in which the enterprise created $2 million of adjusted EBITDA), and that by 2025, the business is aiming to create $1.2 billion of adjusted EBITDA. We will take a look at the math guiding this in the following section.

Compass outlook (Compass Q1 earnings deck)

Meanwhile, at present share price ranges near $5, Compass trades at a marketplace cap of just $2.33 billion. After netting off the $475.9 million of cash on Compass’ most current harmony sheet, the firm’s ensuing business benefit is $1.85 billion. This implies Compass is trading at a portion of this year’s predicted income, and at a <2x multiple of its 2025 targeted adjusted EBITDA.

There’s a huge opportunity here to be seized: don’t miss the chance while the entire market is looking the other way.

The path to profitability lies in adjacent services

One of investors’ biggest criticisms with Compass is that the company effectively bought its growth. This is, admittedly, partially true: Compass achieved tremendous market share so quickly because it took the approach of buying out existing brokerages and slapping the Compass logo on them. The argument that Compass makes in defense of this strategy, however, is that agent productivity rises over time (especially as agents are onboarded onto the Compass platform and brand) and that it will wring out profits on its acquisitions over time.

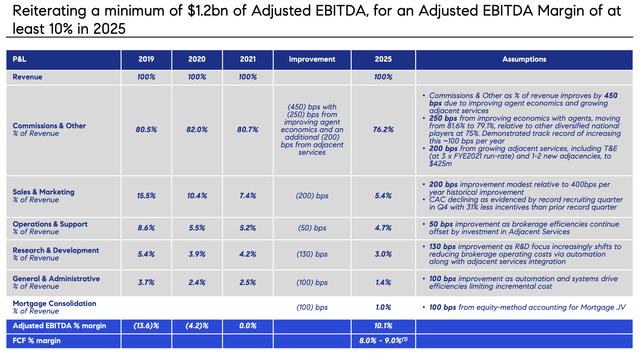

In 2021, the company achieved breakeven adjusted EBITDA margins. By 2025, the company aims to grow its revenue base by ~50% to ~$12 billion, and generate ~10% adjusted EBITDA margins on that revenue.

Compass operating model (Compass Q1 earnings deck)

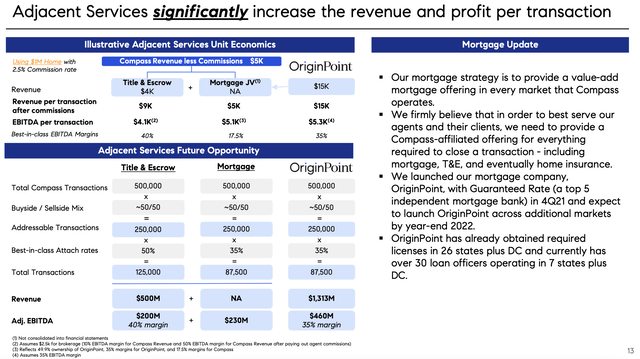

As can be seen in the chart above, the majority (450bps) of this adjusted EBITDA expansion from flat to ~10% margins is expected to be derived from better transaction economics. Of particular importance to Compass’ strategy going forward is expanding its adjacent services in other words, offering title, escrow, and mortgage solutions to the purchase-facet of its transactions.

The chart under illustrates the incrementally of these choices. Title and escrow by yourself can approximately double Compass’ internet revenue per transaction, and mortgage offerings by the firm’s new OriginPoint subsidiary can supply substantially much more than that.

Compass adjacent providers (Compass working model)

Note that these are rather newer offerings. OriginPoint originated its initially home loans just in Q4. And in May possibly, Compass acquired a title enterprise named Consumer’s Title Firm of California, which is licensed in every county in the condition of California. At present, title and escrow companies are only made use of on a mid-one digit percentage of Compass’ purchase-facet transactions, pointing to enormous opportunity for the corporation to keep on to cross-sell this product or service with its brokers.

Progress even now strong

And despite fears of a around-expression housing marketplace collapse, we have not witnessed any deterioration just however in Compass’ benefits.

In Q1, Compass grew its income at a strong 26% y/y pace to $1.4 billion, representing a Q1 document for the company. The chart under reveals as effectively that Compass finished Q1 at a 5.8% trailing twelve-month marketplace share of U.S. real estate, up 150bps y/y. For Q1 by yourself, Compass’ market place share was even larger at 6.1%, up 90bps as opposed to 5.2% in the calendar year-in the past Q1.

Compass progress metrics (Compass Q1 earnings deck)

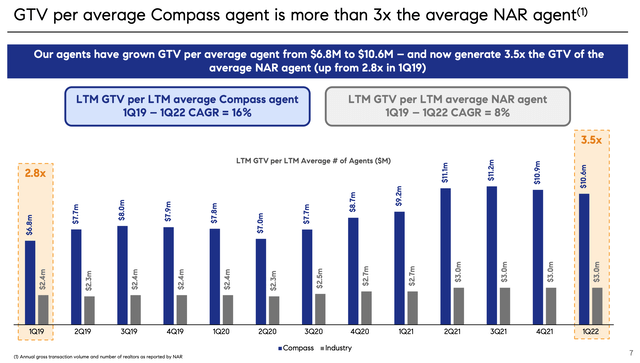

Agent productivity also remains amazingly superior. Compass just isn’t just developing by adding much more brokers to its community, its brokers are also generating significantly more than the sector typical. As shown in the chart below, the normal Compass agent generated $10.6 million in gross transaction worth over the earlier twelve months – which is 3.5x far more than the regular agent in the market.

Compass agent productiveness (Compass Q1 earnings deck)

This is some practical anecdotal commentary from Compass’ outgoing CFO Kristen Ankerbrandt on how the company is observing the real estate current market shape out for the relaxation of the year, designed during her organized remarks on the Q1 earnings call:

The initial six months of the 2nd quarter have resulted in harder times throughout all industries. These headwinds alongside with constrained inventory contributed to a slower start out to the next quarter than we predicted. As a end result our Q2 earnings outlook was afflicted as you will see in our 2nd quarter advice.

But in spite of uncertainty in the recent macro atmosphere, we nonetheless expect sector growth in our marketplaces in 2022 as a end result of powerful continued desire and traditionally low inventory that is driving costs higher. Home costs would have to reverse their present upward pattern and tumble substantially to switch market development unfavorable. We do not think this will come about especially with costs in our marketplaces continuing to boost.

Essential takeaways

I continue to be focused on the prolonged-term prospect for Compass to carry on getting industry share and driving sizeable margin enlargement by way of improved agent efficiency and cross-marketing adjacent solutions. The prolonged-fragmented and localized real estate field is moving towards nationwide consolidation, and Compass has emerged as the leading countrywide model. Stay lengthy below and buy the dip.