How much longer is the DC area’s record housing market sustainable?

Dwelling values in the D.C. metro have been appreciating for 8 several years now, but cracks could be setting up to display.

Household values in the D.C. metro have been appreciating for 8 yrs now, a historic run, and the previous three many years has witnessed pronounced momentum of double-digit rate advancement.

Corey Burr, at TTR Sotheby’s in Chevy Chase, has been representing purchasers and sellers in the D.C. area sector for much more than 30 yrs. He believes the market place is beginning to demonstrate early indications of cracks.

“When 1 calculates the enhance in charges and the enhance in fascination costs, the carrying price tag for homes has long gone up by about a person-3rd in one particular 12 months. That exact same degree of appreciation and desire amount increases is just not sustainable, I never imagine, about time,” Burr mentioned.

But he notes that “over time” is traditionally relative.

“The Federal Reserve increased its fees from 2003 to 2007 by four share factors. And it took until eventually 2008 for the back of residential real estate to be broken, five years immediately after the Fed embarked on its desire fee boosts. The current Fed has improved costs just just one-quarter of one per cent, so we are a extended way from getting the cumulative outcome of extra costly money on household revenue,” Burr said.

Burr does imagine the cost of revenue at this time has not risen to a stage that, by itself, would drastically sluggish revenue in the D.C. marketplace. But he does predict 30-calendar year mortgage fees could access 6%, or even 7%, a few several years from now.

Other elements that could effect the area household real estate market place heading forward contain unreasonable checklist prices by sellers, which Burr reported he has not seen nevertheless, homes sitting down on the market more time, record rate reductions by sellers, a buildup in inventory or additional purchaser contingencies in presents.

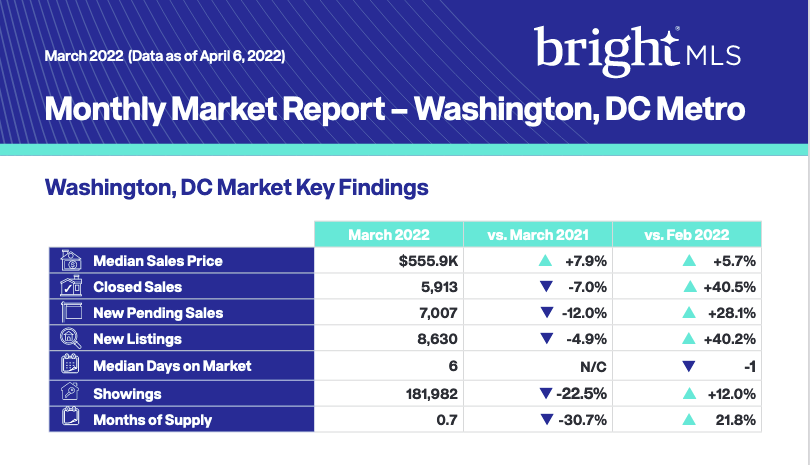

Property gross sales in the D.C. location do go on to sluggish. Closed sales in March have been 7% decreased than March of previous yr, and pending profits, or contracts signed to get but revenue not however closed, ended up down 12% year-in excess of-year, according to listing service Bright MLS.

The median rate of a house sale in the D.C. spot previous month was $555,900, up 7.9% from a yr earlier.

In Northern Virginia, the median promoting value is now $650,000, 9% far more than a 12 months ago, in accordance to the Northern Virginia Affiliation of Realtors, which also notes a 5% drop in year-more than-calendar year profits.

Vibrant MLS’ Household Demand Index, primarily based on listing queries and agent showings, is in the “moderate” vary and the index is down 18.5% from this time last 12 months.

Eventually, Burr believes the DC region’s housing marketplace will honest better than some other large metros when the housing industry slows.

“The area stays excellent for more youthful folks. It has a suburban experience, there are lots or parks, the mountains and ocean are nearby, there are quite a few significant-spending employment, it is a magnet for personal businesses, there are superb universities, and a well-educated workforce, all of which really should guidance a market place downturn,” he reported.

Under is a snapshot of March sales action in the D.C. metro location: