Weekend reads: Your guide to bear markets for stocks, crypto and, soon, housing

The S&P 500 index plunged 23.6% from its closing superior on Jan. 4 by way of June 16. The destruction have been broad — on June 16, 97% of shares in the benchmark index were being down, with extra than a 3rd dropping at least 5%.

A bear sector is no entertaining to hold out as a result of, but the U.S. inventory market

DJIA,

has normally recovered from this type of decrease. From a then-closing-record on Feb. 19, 2020, the S&P

SPX,

collapsed 34% via March 23, 2020, but by Aug. 18, 2020, new documents were being staying established as investors’ fears have been eased by monetary and fiscal stimulus to fight COVID-19. This time all around, traders may perhaps have extended to hold out because of the uncertainty in excess of regardless of whether the Federal Reserve’s coverage moves to fight inflation will direct to a recession.

Mark Hulbert appears to be like at the historical past of bear markets again to 1990, and one of his conclusions may possibly surprise you in a very good way.

Additional from Hulbert about this bear sector:

Guidance for navigating the bear market

MarketWatch photograph illustration/iStockphoto

Michael Honest talks to an investor with 70 decades of practical experience who shares 4 techniques he has made use of to trip via bear marketplaces.

Isabel Wang shares advice from two strategists on what buyers should really do for the duration of a bear market.

Lawrence McMillan warns alternatives traders not to be fooled by bear-marketplace rallies.

Michael Brush weighs in with 7 factors the beleaguered biotech sector is now a “buy”.

For investors nervous about their retirement accounts, Brett Arends shares classes uncovered by myriad money crises about the past 25 several years.

A cooling housing market place

Mortgage-bank loan fascination premiums have nearly doubled this 12 months. Quentin Fottrell explains the consequences on home potential buyers and talks to marketplace insiders about how the housing industry is very likely to improve.

Aarthi Swaminathan digs into parts in Utah that boomed as new people fled additional highly-priced housing marketplaces. Here’s what these marketplaces glance like now..

Extra housing protection:

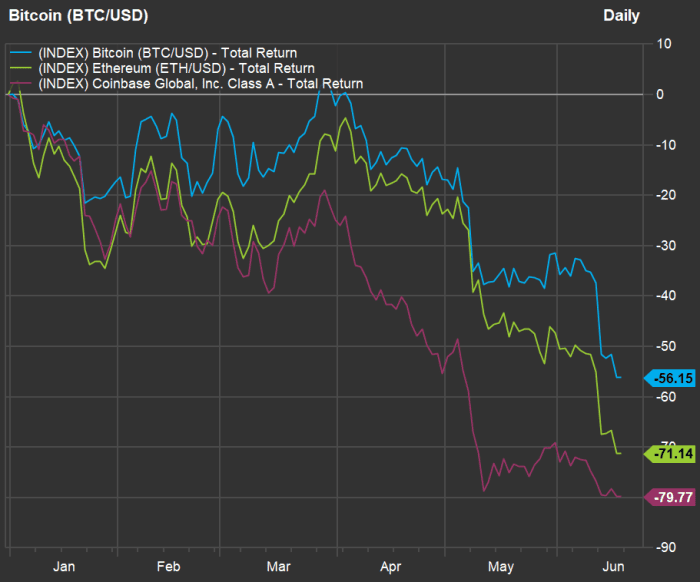

The Crypto bears

FactSet

This chart reveals this year’s declines for bitcoin

BTCUSD,

Ethereum

ETHE,

and Coinbase

COIN,

the crypto exchange which this 7 days explained it would reduce 18% of its workforce.

A single brutal aspect result of the slide in cryptocurrency prices was the motion by Celsius Networks, a crypto loan company, to halt withdrawals by account holders who experienced manufactured dollars deposits. Here’s a search at similar problems spreading by way of the crypto business.

Frances Yue digs into the the metrics of the crisis for digital currencies in this week’s edition of her Distributed Ledger column.

A lot more coverage of the fallout from bitcoin’s slide:

Inflation and the Federal Reserve

On June 15 the Federal Reserve raised the concentrate on range for the federal money level by .75% to a goal array of 1.5% to 1.75%, as aspect of an effort to great inflation. This was the major enhance in the federal funds fee in a few decades.

Greg Robb shares 4 takeaways from Federal Reserve Chairman Jerome Powell’s press meeting that followed the central bank’s policy announcement.

Rex Nutting believes the Fed’s evaluation of the economy is incorrect and that the economic climate is in fact slowing now.

Andrew Keshner shares a few economic moves that can help you during a period of climbing desire charges.

Associated coverage:

Inflation and retirement

Should really significant inflation adjust your retirement designs? It’s possible — right here are numbers to operate now.

Additional retirement and arranging protection:

- No make any difference the earnings bracket, LGBTQ investors are a lot less assured about retirement than their non-LGBTQ peers

- 8 cash lessons for the class of 2022

Pleasure, politics and revenue

MarketWatch image illustration/iStockphoto

Just one effortless way for companies to rejoice their virtues is by taking part in Pride Month. But some of the very same corporations patting on their own on the again have been slippery — supporting fund campaigns of politicians who have supported anti-LGBTQ laws, as Ciara Linnane stories.

Yet another challenge in a earth of provide shortages

Cargo robbers loaded up through the pandemic. In this article are the merchandise they most like to steal, as Claudia Assis describes.

The “Great Resignation” could be more than

MarketWatch picture illustration/iStockphoto

The seller’s industry for labor may perhaps be at an close for U.S. tech companies, as financial investment money dries up, Jon Swartz stories.

Want a lot more from MarketWatch? Indication up for this and other newsletters, and get the most recent information, private finance and investing guidance.